How to Establish a Fair Valuation Estimate for a Successful Capital Raise

Attempting to raise capital without considering how investors might value your company could set you back months, if not years, on your fundraising journey, and it’s a mistake we’ve seen countless startups make when raising capital for the first time. The CPVS™ custom valuation estimate is a key feature of our capital planning process that helps lay the foundation for your offering. Our goal is to propose a “fair value” offering price for your capital raise that accurately reflects your company’s revenue potential and financial prospects.

Establishing a fair valuation estimate will leave you better prepared for your capital raise and allow you to answer questions such as the following:

Can I raise my target level of funding and keep founders in control at a realistic valuation?

How does the offering price affect my cap table structure and shareholder dilution?

What kind of proceeds can selling shareholders expect to generate in my offering?

Based on a fair offering price, what’s the most I can raise if I want to keep founders in control?

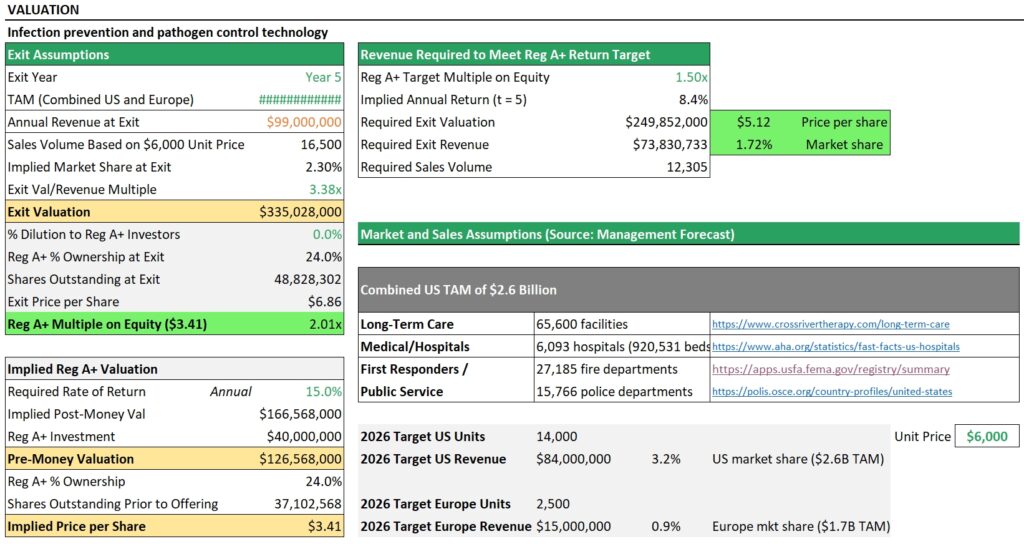

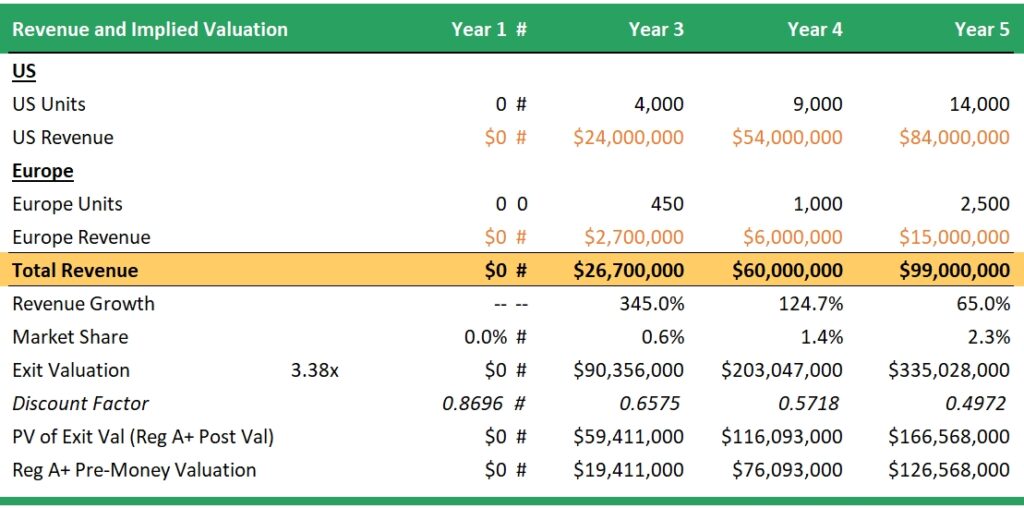

Valuation is as much an art as it is a science, and there are a variety of techniques that can be used to estimate a company’s market value, some of which you can read about here: 4 Valuation Methods. Our valuation assessment utilizes the Venture Capital Method of business valuation, the preferred method of valuation used by venture capital firms to value startups and early-stage businesses with minimal cash flow.

Startup valuations are notoriously difficult to estimate due to the lack of operating history and financial data needed to perform a market-based comps analysis. Early-stage medtech companies undergoing product development and clinical trials can go years without generating a profit or seeing a single dollar of revenue. Valuing these companies based on current metrics would make little sense – unless they were expected to remain startups indefinitely.

The Venture Capital method looks at a startup’s valuation from the perspective of an investor and is concerned with the expected return on investment at the time of exit – typically three to eight years for most venture capital firms.

The idea is to determine, based on reasonable estimates of what a company might be worth in the future (“terminal value”), what the company should be worth today in order to satisfy an investor’s return requirement over the hold period.

The company’s current financial status has no bearing on valuation – what matters is future output. By analyzing your TAM, revenue projections, and growth potential, we can “back into” a fair valuation for your company’s offering.

The CPVS™ custom valuation estimate begins with a forecast of your company’s financials (revenue, EBITDA, etc.) and an assumption for investor hold period (five years is standard). Using revenue and profit forecasts, terminal value is then computed using valuation multiples (Val/Rev, Val/EBITDA) from comparable exits (acquisitions, buyouts, IPOs) in the same or similar industries.

This hypothetical exit value is discounted at the investor’s required annual rate of return to arrive at a “present value” which represents the valuation of your company today at the time of investment. If the investor bought in at this valuation and sold his shares at the projected exit valuation, he’d achieve his return target. The discount rate can also be thought of as the opportunity cost of capital – the rate of return your investors would expect from a similar investment of equal risk.

This return requirement takes several variables into account, including:

- Risk-free rate: what an investor could earn by investing in “risk-free” government bonds. The current yield on 5-year treasury bills is 3.93%.

- Equity risk premium: the additional return above the risk-free rate required to invest in equity securities. The average equity risk premium over the past 10 years is 5.6%.

- Beta: a measure of a company’s volatility or systematic risk relative to the overall market. The historical beta for healthcare product manufacturers is 1.16 (returns for healthcare product companies are 16% more volatile than the market as a whole).

- Startup risk premium: an additional risk premium is used to account for startup risk.

The formula is as follows:

Required return = Risk-free rate + (Beta * Equity risk premium) + Startup risk premium

Discount rates vary significantly depending on a company’s business stage, financing status, industry, market prospects, and investor profile. Early-stage pre-revenue investments typically require much higher rates of return than investments in cash-flow generating enterprises in order to compensate investors for higher risk and the opportunity cost of forgoing profits or dividends. Similarly, companies operating in industries with intense competition under threat of technological disruption garner higher discount rates than companies with durable competitive advantages and predictable cash flows.

After we establish a “fair” valuation for your company we can then calculate the implied share price for your offering based on your pro-forma cap table, taking into account all outstanding and dilutive securities including stock options, warrants, and convertible notes. Any additional shares needed to keep founders and key executives in control will be considered as well.

Most financial platforms and advisors don’t do any kind of forward-looking valuation analysis to prepare clients for their capital raise. In most cases an offering price is set arbitrarily, without any consideration as to what such a price would mean for the company’s valuation and whether such a valuation could be justified in light of the company’s financial prospects and growth potential.

The result is that securities are often overpriced, which can negatively impact a company’s ability to raise capital – especially when big money institutions, high-net-worth individuals, and more sophisticated investors are involved.

By determining a reasonable valuation and pricing your offering based on that valuation, we can increase your chances of a successful offering.

The CPVS™ valuation analysis also serves as a learning tool that allows you to gauge the impact of different revenue, growth, and investor return assumptions on your company’s valuation and offering price. The valuation estimate is highly sensitive to these assumptions, so it’s worth spending some time making sure your financial projections are realistic and achievable. You’ll also be able to forecast, for a given offering price, the level of revenue you would need to generate in the future to meet an investor’s return requirement.

If this revenue target seems too high or too low based on your knowledge of your company’s TAM and market potential, you can adjust the revenue projections accordingly. Playing with the assumptions will give you a better understanding of the valuation process and how investors might analyze your offering.

To learn more about a valuation estimate for your company, Schedule a call, and let’s talk!